What Is Treasury Management? A Guide To Systems & Solutions

Are you still relying on spreadsheets to manage your company's finances? It's time to face the reality: clinging to outdated methods is a surefire way to stifle growth and invite financial chaos. A robust treasury management system (TMS) is no longer a luxury but a necessity for businesses navigating today's complex economic landscape.

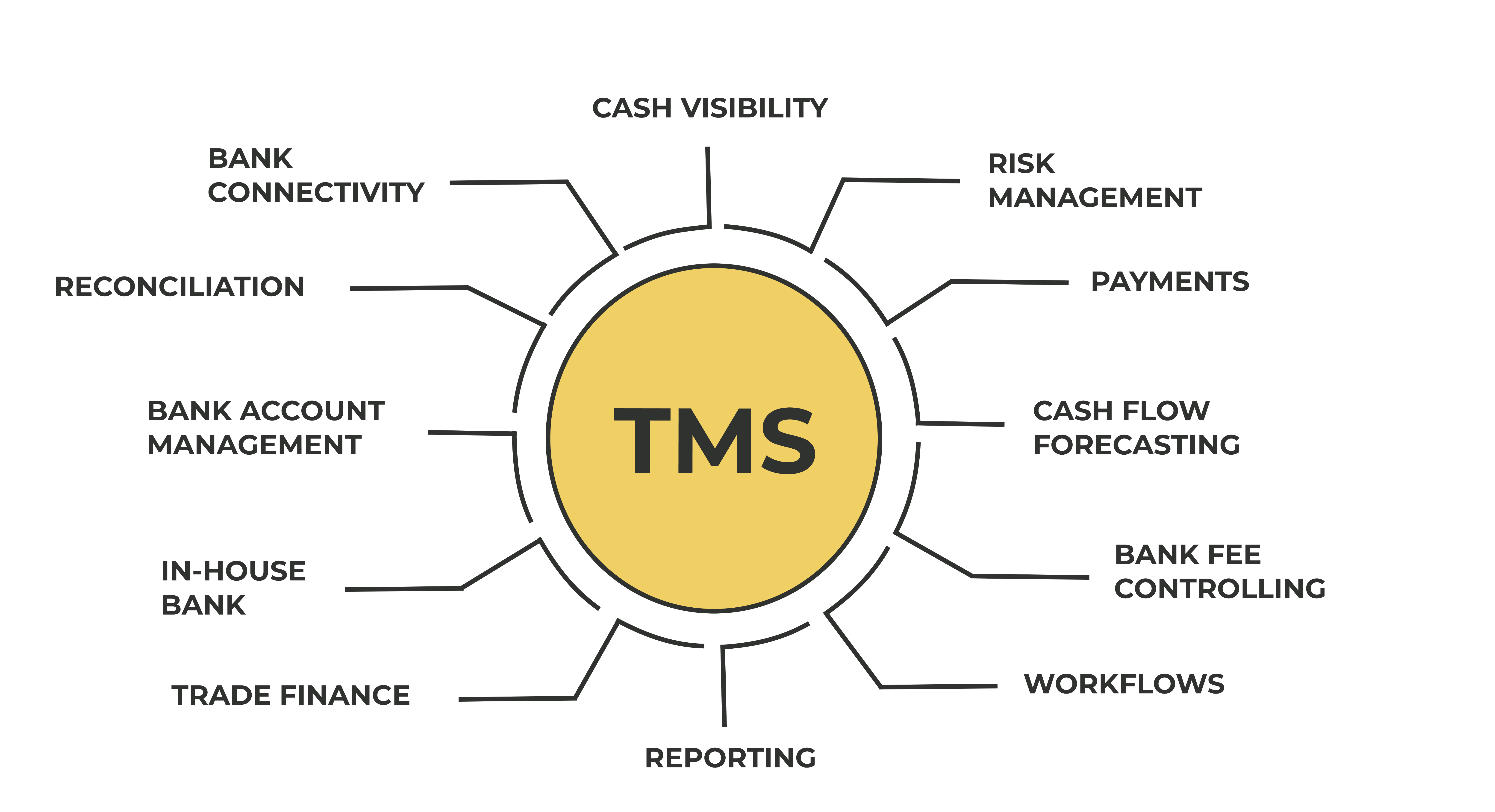

A treasury management system (TMS) is a comprehensive solution designed to streamline and optimize a business's cash flow, liquidity, payments, and overall financial risk management. It provides a centralized platform for managing all treasury-related activities, offering enhanced visibility and control over financial assets. Why is this so critical? Because in the absence of such a system, organizations often struggle with fragmented data, manual processes, and limited insights, leading to inefficiencies, errors, and increased financial vulnerabilities.

| Aspect | Details |

|---|---|

| Definition | A treasury management system (TMS) is a software solution designed to centralize and automate a company's treasury operations. |

| Key Functions |

|

| Benefits |

|

| Key Features |

|

| Integration | TMS integrates with other financial systems such as ERP (Enterprise Resource Planning), accounting software, and banking platforms. APIs (Application Programming Interfaces) facilitate seamless data exchange. |

| Market Size | The global treasury management system market is projected to reach over $16 billion by 2032, indicating a significant shift towards adoption. |

| Role of Providers | TMS providers offer businesses the necessary tools for effective financial management and help optimize financial strategies. |

| Risk Management Components |

|

| Treasury vs. Finance | Corporate finance focuses on long-term funding and investment strategies, while treasury handles the tactical execution of cash management, risk, and liquidity. |

| Liquidity Management | Treasury plays a crucial role in ensuring the company has sufficient liquidity to meet its obligations. |

| Platforms | Platforms like Profituity's Platformnext offer features to simplify treasury management. |

| Interest Rate Risk | Managing fluctuations in interest rates is a critical aspect of treasury management. |

| SAP Treasury | SAP Treasury and Risk Management helps manage liquidity and mitigate financial risks. |

| Spend Management | An automated spend management platform provides visibility and control over treasury operations. |

- Blue Ivy Carter In 2025 Whats Next For Beyoncs Daughter

- Edvin Ryding Quiz Young Royals Facts Fun Insights Inside

Benefits of a centralized and digitalized Treasury Management

Introduction to Treasury Management Process YouTube

What is a Treasury Management System? Advantages, Benefits & Solution