CA FTB: Resolve Delinquent Tax Returns & Obligations [Guide]

Are you navigating the complex landscape of California taxes and feeling lost? It's a sentiment many share. Understanding and complying with the California Franchise Tax Board (FTB) regulations is critical for both individuals and businesses operating within the Golden State.

The California Franchise Tax Board (FTB) stands as the state agency vested with the responsibility of administering California's personal income tax, corporation tax, and franchise tax. Beyond these core functions, the FTB plays a pivotal role in collecting and distributing property taxes, ensuring that these funds are allocated appropriately across the state. Moreover, the FTB is committed to providing comprehensive customer service and support to taxpayers, acting as a resource for those seeking guidance on their tax obligations. Headquartered in Sacramento, California, the FTB maintains a network of offices throughout the state, ensuring accessibility for taxpayers across California.

| Agency Name | California Franchise Tax Board (FTB) |

| Responsibilities | Administering California's personal income tax, corporation tax, and franchise tax; collecting and distributing property taxes; providing customer service and support to taxpayers. |

| Headquarters | Sacramento, California |

| Website | ftb.ca.gov |

| Accessibility Certification Date | July 1, 2023 |

| Compliance | California Government Code Sections 7405, 11135 |

For nonresidents, understanding your filing obligations is paramount. As a nonresident, your tax liability is based on your taxable income derived from California sources. This "sourced income" encompasses various forms of revenue, including, but not limited to, rent from real property located in California and the sale or transfer of real California property.

- Celeb Bio Melissa Oneil Height Weight More Exposed

- Fact Check Greg Gutfeld Cancer Rumors Truth Revealed

The FTB offers a suite of online services to streamline the tax process. Taxpayers can conveniently file returns, make payments, and check their refund status through their MyFTB account. The platform provides access to popular topics and a range of online services designed to simplify tax management.

California residents can take advantage of valuable tax credits, such as the California Earned Income Tax Credit (CalEITC). Last year, over 3.5 million CalEITC credits were issued, putting more than $1.4 billion back into the pockets of Californians. To estimate potential credits and learn more, visit ftb.ca.gov/caleitc. Best of all, the CalEITC is free.

Navigating the payment process can sometimes present challenges. Taxpayers often encounter the "How would you like to pay your California taxes?" page, which typically requires either direct deposit or payment by check. While these are common options, the FTB provides a range of alternatives to accommodate different preferences.

- Robin Williams Net Worth What Happened To His Fortune Facts

- Egpaf Fighting Pediatric Hivaids Globally Making A Difference

If you find yourself in a situation where you've overpaid your taxes, rest assured that you may be entitled to a refund. The FTB offers various payment options, including electronic funds transfer, credit card payments, and payments via check. For online payments, visit the FTB's website. Details regarding FTB payment options are available online.

When making payments via check or money order, ensure that it is made payable to the "Franchise Tax Board." This will help ensure that your payment is processed correctly and credited to your account.

If you're in the process of concluding business operations in California, filing your final current year tax return is a critical step. Be sure to check the applicable final return box on the first page of the return. This signifies that you're stopping doing business in California after the final taxable year.

For guidance on dissolving, surrendering, or canceling a California business entity, refer to FTB Publication 1038, available at ftb.ca.gov/forms. This comprehensive guide provides detailed instructions and requirements for formally closing a business in California.

The FTB is responsible for imposing and collecting the franchise tax within the state of California. Understanding the nuances of this tax is essential for businesses operating in the state.

In addition to state taxes, businesses may also have to file and pay federal income and estimated taxes with the IRS. It's crucial to ensure compliance with both state and federal tax obligations.

For additional information on dissolving, surrendering, or canceling a California business entity, consult FTB Publication 1038. This resource provides step-by-step instructions and clarifies the requirements for completing this process.

Even if your business is not physically located in California, you may still have California source income if you sell goods to California customers or perform a service to customers who receive the benefit of that service in California. Owning an intangible used in California can also create source income. This is known as apportionment and allocation.

The FTB offers an electronic filing system to facilitate the submission of tax returns. This system provides a convenient and efficient way to meet your filing obligations. The FTB's electronic filing system offers a streamlined approach to submitting tax returns, promoting efficiency and accuracy.

For detailed information about the rules and regulations for filing a franchise tax return in California, consult the Franchise Tax Board Manual. This manual provides comprehensive guidance on all aspects of franchise tax compliance.

FTB Publication 17 offers an overview of California taxes. This publication offers valuable insights into the state's tax system, helping taxpayers understand their obligations and rights.

When submitting payments via check or money order, use black or blue ink and make the payment payable to the "Franchise Tax Board." Write the California SOS file number, FEIN, and "2019 FTB 3522" on the check or money order to ensure proper identification. Detach the payment voucher from the bottom of the page, staple your payment to the voucher, and mail it to the address provided by the FTB.

The California Franchise Tax Board website is designed, developed, and maintained to be accessible, denoting compliance with California Government Code Sections 7405 and 11135. This certification, dated July 1, 2023, reflects the FTB's commitment to inclusivity.

You can make California Franchise Tax Board payments online using your bank account for free. This option provides a convenient and secure way to fulfill your tax obligations.

Alternatively, you can pay online via credit card through ACI Payments (formerly Official Payments) for a fee. While this option offers flexibility, it's important to be aware of the associated charges.

Another option is to pay by mailing a check, money order, or cashier's check, or by paying in person at a field office. These methods provide traditional alternatives for those who prefer not to pay online.

The California Franchise Tax Board website is designed, developed, and maintained to be accessible. This certification, dated July 1, 2023, reflects the FTB's commitment to inclusivity.

When submitting payments via check or money order, use black or blue ink and make the payment payable to the "Franchise Tax Board." Write the California SOS file number, FEIN, and "2024 FTB 3522" on the check or money order to ensure proper identification. Detach the payment voucher from the bottom of the page, staple your payment to the voucher, and mail it to the address provided by the FTB.

Taxpayers retain the right to challenge tax assessments. They can pay the tax liability and subsequently file a claim for refund. If the claim is denied, they may generally file an action against the FTB in California Superior Court within 90 days.

However, it's crucial to note that not all rules are consistent. For example, a suit for refund on a residency case must be filed within 60 days. Navigating these nuances requires careful attention to detail and understanding of applicable regulations.

For further information, consult FTB Publication 1100, "Taxation of Nonresidents and Individuals Who Change Residency." This publication provides detailed guidance on the tax implications of residency status.

Under California law, registered domestic partners (RDPs) must file their California income tax returns using either the married/RDP filing jointly or married/RDP filing separately filing status. Understanding these requirements is essential for RDPs to ensure accurate tax filing.

Your filing requirement also depends on your gross income. If your gross income from all sources (both California sources and sources outside of California), reduced or increased by all California income adjustments, exceeds the amounts shown on the chart provided by the FTB for your filing status, age, and number of dependents, you are required to file.

- Decoding The Viral Yellow Dress Rock Paper Scissors Video

- Monica Lewinskys Husband Untold Truths Her Private Life

2021 Form CA FTB 8879 Fill Online, Printable, Fillable, Blank pdfFiller

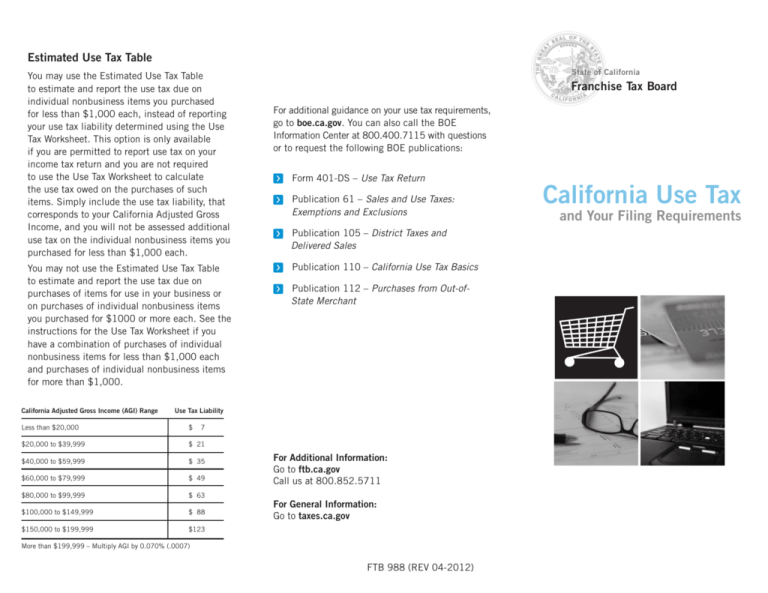

FTB 988 California Use Tax and Your Filing Requirements

File CA FTB Form 199 with TaxZerone Nonprofit Filing Guide